SELF EMPLOYMENT TAX CREDIT

You could be eligible for up to $32,220 in tax credits from 2020-2021

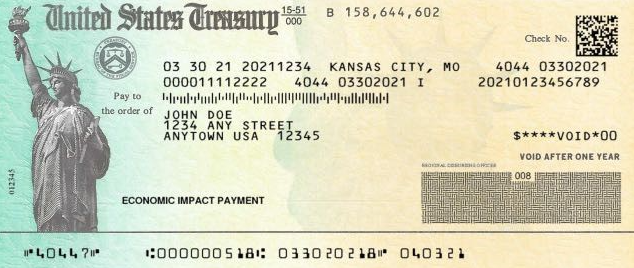

The government has set aside money for you as part of COVID-19 relief efforts. If you're a self-employed business owner, a 1099 subcontractor, or run a family-centered small business, you could be eligible for the SETC. And if you don't claim it, the money goes back to the government.

$32,220 Credit

Not a LOAN

Not Taxable

Receive your check in weeks

Does not have to be repaid

It takes just 5 minutes to see if you qualify! This is not a loan - it's a government-backed relief payment.

What is the Self Employement Tax Credit?

How do I know if I qualify?

You must be of Self-Employed status and have filed a Schedule C or Partnership 1065 on your federal tax returns for 2020 and 2021. If you battled COVID, experienced COVID-like symptoms, had to quarantine, underwent testing, or cared for a family member affected by the virus, you could be eligible. If the closure of your child's school or daycare due to COVID restrictions impacted your work, we're here to help.

Is this for real? How do I know it's not a scam?

It's 100% real - the government sets aside money for many things, and this is just one of many programs where money is available for you to request. The government does not advertise it, but still there are many small business programs available for you to potentially benefit from. This is your money to qualify for through our site.

It is understandable to have doubts about the legitimacy of government programs. However, the information provided can help address your concerns.

The government does allocate funds for various programs, including the Paid Sick and Family Leave Credit program. While the government may not actively advertise these programs, they are available for individuals and businesses to request.

It is important to note that this program has a limited time frame. The government has introduced several programs for small businesses, and the Paid Sick and Family Leave Credit is one of them.

To alleviate any skepticism, it is recommended to conduct your own research. You can visit the IRS website, where you will find information about the Paid Sick and Family Leave Credit program. Additionally, you can refer to the Intuit – QuickBooks website for more information about stimulus packages, self-employment tax credits, and tax deferrals related to COVID-19.

Here are the links for your reference:

IRS website - Paid Sick and Family Leave Credit

https://www.irs.gov/newsroom/paid-sick-and-family-leave-credit-2020-vs-2021-comparison-chart

Intuit - QuickBooks website - Stimulus, Self-Employed Tax Credits, and Social Security Tax Deferrals

By reviewing the provided information from these reputable sources, you can verify the legitimacy of the program.

Office: Dover Delaware

Call 610-312-9907

Email: Griffin@businessadvancepro.com